The Challenge

Our client has a highly-popular international food item (a non-meat Turkish street fare) which they would like to introduce into the U.S. food market.

– Explore how consumers might use the product

– Determine how to position the product in the U.S.

– Identify any product adjustments to better fit the U.S. palate

Our Approach

Conduct qualitative focus group discussions with potential consumers who are open to the idea of a popular Turkish street food fare. We offered a buffet to allow sampling and pairings and looked for consumers who were “adventurous eaters” – those who have tried other international foods, such as Falafel, Gyros, Hummus, Tabbouleh, and Tar-tar.

What We Learned

Overall, the product was well-liked and generated excitement as a new flavor experience with multiple usage occasions.

Product

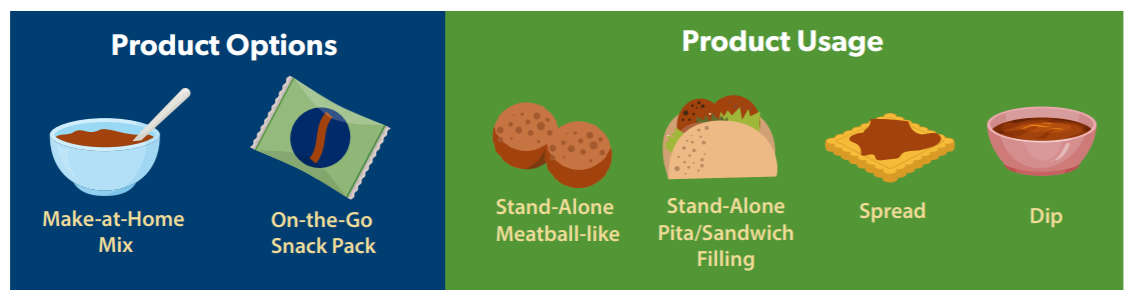

Because we did not define how this food product should be consumed, we were able to explore what was interesting/desirable to US consumers, versus setting expectations as to how it is typically consumed (in other countries).

– The expected form – a dry mix – wasn’t perceived as highly desirable, but once consumers were allowed to “play with the product” new ideas were uncovered.

– Consumers also identified additional usage occasions, aside from the typical “street fare”.

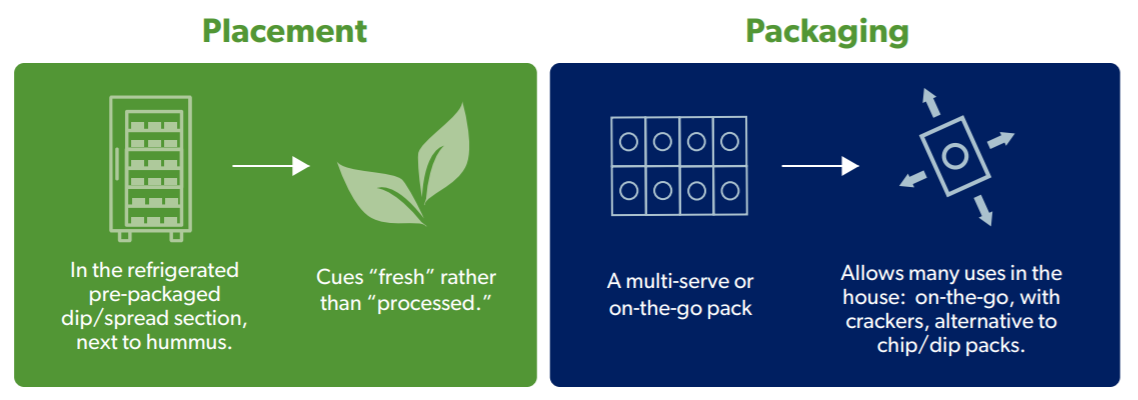

Marketing

The Turkish roots of the product were a highly appealing feature. And, anchoring to other established international products offers familiarity yet a sense of adventure. However – while meatless – the product should not be marketed as vegan as that label is too restrictive.

Want more? View the case study.